UPDATED: The Federal Energy Policy Act of 2005 (aka EPAct) established a $2000 tax credit for eligible contractors / builders for every new home sold that is certified to meet certain “energy efficiency” standards. While this was initially scheduled to expire at the end of 2007, the tax credit has been extended several times, and is now set to expire at the end of 2021.

UPDATED: The Federal Energy Policy Act of 2005 (aka EPAct) established a $2000 tax credit for eligible contractors / builders for every new home sold that is certified to meet certain “energy efficiency” standards. While this was initially scheduled to expire at the end of 2007, the tax credit has been extended several times, and is now set to expire at the end of 2021.

Heads up – just because this tax credit may show up as expired, it might still be worth pursuing. Why? Well, it has a funny way of managing to get resurrected which you can thank the NAHB & others for. For example back in December 2019 – the credit was extended once more to include homes built in 2018 & 2019 (this credit had expired at end of 2017) and new homes built in 2020.

What is a “qualified home”?

Per IRS Form 8908;

- A qualifying home is one that is designed, built & certified that it’s heating & cooling energy needs should be 50% less than a similar one (aka a reference house) built to the 2006 IECC (prior to 2012 they referenced the 2003 IECC with 2004 supplement)

- At least 1/5 of the 50% reduction must be due to building envelope improvements.

- It must be built in the United States and at this time it must be substantially completed and sold (or leased) before January 1st, 2014, for use as a residence.

- Older houses undergoing substantial reconstruction and rehabilitation work can also qualify if they meet the standards required

Are multi-family homes (duplex, triplex, etc…) eligible for the tax credit?

Yes per 2008-35 & IRC 45L – the IRS defines all homes / dwelling units are eligible as long as the building is not more than three stories above grade in height. A dwelling unit counts as a “single unit providing complete independent living facilities for one or more persons, including permanent provisions for living, sleeping, eating, cooking and sanitation.”

Can a homeowner apply for the tax credit?

No, only eligible contractors can apply for the tax credit – remember one of the criteria is the house must be sold or leased, not built for one to live in.

What is an eligible contractor?

This can get a little tricky & if in doubt about this (or anything else in this article) you should consult your accountant / tax preparer. With that someone that builds & sells /leases spec homes easily qualifies. Production Home Builders also qualify. Custom Home Builders though fall into a slightly gray area (based on how they do business) as they are not really selling or leasing the home which ties into the “developer” clause. Per the IRS “A person must own and have a basis in the qualified energy efficient home during its construction to qualify as an eligible contractor with respect to the home.” So if a person hires a third party contractor to construct said home and then sells said home; “the person that hires the third party contractor to construct the home owns and has the basis in the home during its construction. The person that hires the third party contractor is the eligible contractor and the third party contractor is not an eligible contractor.”

What’s does this certification entail?

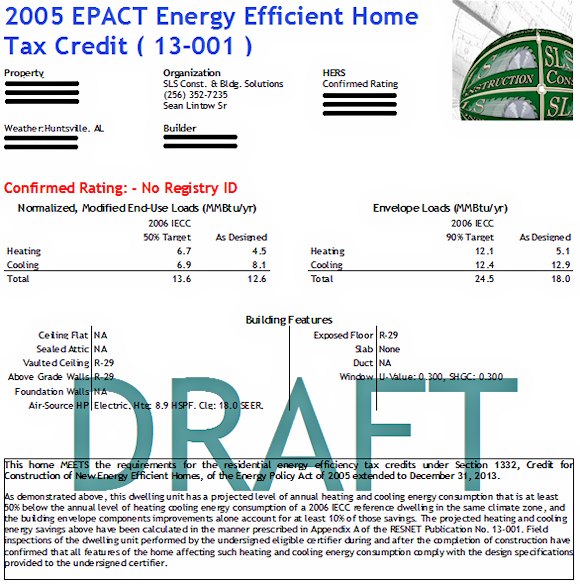

It does requires an eligible certifier that is NOT related to the builder and has been accredited or otherwise authorized by RESNET to use energy performance measurement methods approved by them (aka a HERS rating.) In a nutshell, a projected rating is done to see if the house as designed will qualify & if it won’t to see what it will take. There is a pre-drywall inspection to verify the quality of insulation that was installed followed up by a final inspection which includes a blower door test, duct leakage test & we verify everything that was listed in the projected rating is correct.

Wow this sounds complicated…

Hmmm I didn’t really catch a question there, but most of those steps above are all done behind the scenes with very little to no interruptions for you. As more & more locals are adopting the newer energy codes, some of these steps are already required (like the blower door & duct leakage testing.) Speaking of the new codes, you may actually already qualify for the credit depending on materials chosen as the tightness requirements are pretty much already taken care of. If you need to bump something to qualify you have a wide range of energy efficiency measures you can choose from. For example; insulating the foundation, increasing the amount in the walls &/or ceilings; lighter colored roofing, going with Low-E glass, bumping up the SEER or HSPF of the units you are installing…

Hmmm, okay but I don’t really like paperwork…

That’s ok because there is very little for you to do or worry about. For every house that “passes’ you would get a form like this one below (A proper one will not show “DRAFT” & it will have a registry ID, be fully filled out, and have a signature with a certification clause).

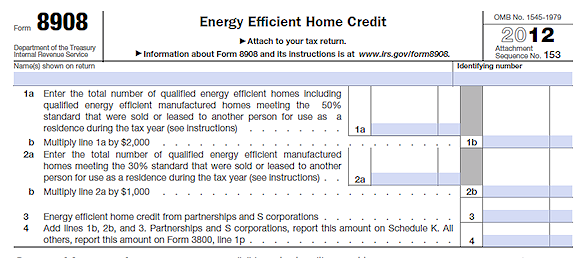

At the end of the year you simply add up how many passed & you sold and you fill out Form 8908 accordingly or simply place the appropriate numbers on Form 3800 under Business Credits (or better yet turn it over to your accountant or tax advisor.)

Wow, can I use this for past homes I built?

Sorry, but I would tend to say no unless you had a rating done on those houses before they were completed.

Well all my houses were /are ENERGY STAR, LEED, NGBS &/or (insert your regional program here); does this mean I will meet the requirements?

Possibly but highly unlikely on older versions where one just met the base requirements. The nice thing is many of those programs require a HERS rating & it shouldn’t take much to have your rater check to see if you qualified. With that the requirements to meet those programs requirements and the tax credit are different. Many of those focus on the whole house & not just the space heating and cooling.

Wait a sec, my rater just said he can’t do this…

Welcome to another slightly gray area as RESNET has stated “RESNET requires that the rating firm/individual must carry professional liability insurance in the amount of least $500,000” before they will be considered “accredited”. This line was based on an older IRS standard where the new one reads “been accredited or otherwise authorized by RESNET (or an equivalent rating network) to use energy performance measurement methods approved by RESNET (or the equivalent rating network).” Well as all Raters still in good standing qualify at minimum under the “otherwise authorized” as the rating software is what we use every day. The catch is how their provider views this as they actually hold the key to drop the word “DRAFT” off the official report and allow it to be printed. (Hopefully one or will drop by and clarify this as needed) With that, all a rater needs to do is get the insurance & inform RESNET & they are then considered accredited. Of course with Professional Liability Rates starting in the low thousands… If you are considering doing this, make sure your rater is either authorized or will become accredited if needed.

For More; RESNET Tax Credit Standard 13-001 – RESNET Home Energy Rating Standard – IRS 2008-35